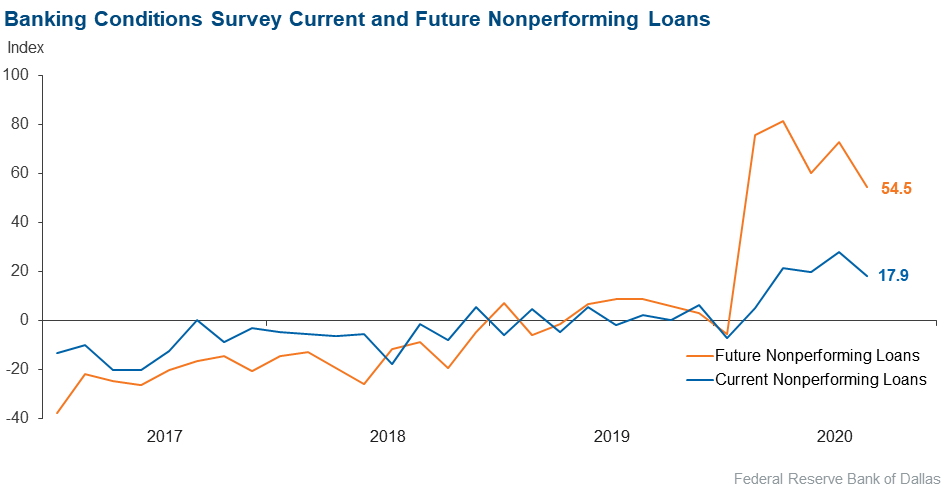

An increasing number of Texans are behind on loans, according to a survey of 78 financial institutions by the Federal Reserve Bank of Dallas.

The twice quarterly Banking Conditions Survey found that 28.2% of surveyed banks and credit unions were seeing an increase in nonperforming loans over the past six weeks.

That proportion compares to a recent pre-pandemic low of 9.1% in a February survey, and it is roughly twice as high as the survey’s three-year average.

Not all lenders are equally affected. The survey found that 61.5% financial institutions saw no change to the percentage of nonperforming loans, while 10.3% reported improvement.

The survey relied on responses from CEOs or senior loan officers, with data collected September 22–30. The survey includes some data from southern New Mexico and northern Louisiana, which is part of the jurisdiction covered by the Dallas Federal Reserve.

According to the survey, home loans are faring relatively better than commercial loans — likely in part because of Congressionally mandated forbearance programs for loans backed by government-run secondary lenders Fannie Mae and Freddie Mac. Only 2.5% of survey respondents reported an uptick in nonperforming residential mortgages.

By contrast, 14.3% of banks recorded more nonperforming commercial real estate loans, and 11.5% saw a deterioration of consumer loans, a category that includes personal credit cards.

Commercial and industrial loans also are taking a hit, with 13.9% of banks reporting more nonperforming loans in that category. Only one financial institution in the region saw improvement in the performances of its commercial and industrial loans.

Texas banks have exposure to hard-hit retail businesses and restaurants, and the energy sector, which is suffering from oil prices stalled at about $40 a barrel.

As more borrowers default on loans, banks increasingly are tightening their credit standards. The survey found 22.7% of banks tightened credit standards, compared to 1.3% that eased.

In terms of the outlook for the next six months, 61% of banks and credit unions expect their loan book to further deteriorate in quality, despite a near majority saying that business activity currently is picking up.

“COVID-19 issues and issues surrounding the fall election are my greatest concerns,” commented one banker. “To date, we have not seen a decline in credit quality, but we expect some deterioration beginning toward the end of the year or first quarter 2021,” said another.

Why It Matters

- Loan performance provides a window into the economy, helping to understand the whether more or fewer businesses are defaulting on loans compared to past periods.

- Tightening credit conditions mean banks are more skeptical of borrowers, making it potentially harder for you to get a loan.

- Rising nonperforming loans would cause banks to set aside more money as loss provisions, reducing profitability at banks and hurting the financial sector of the economy.