The U.S. Producer Price Index jumped to a nearly 10-year high in March as producers reported higher prices of diesel fuel, electric power, industrial chemicals, steel mill products, plastics, machinery, and freight.

March’s reading of 1% was twice the forecast of 0.5% by economists polled by Reuters. For the 12-month period ended in March, the change was 4.2%, outpacing forecasts of 3.8%.

James Knightley, Chief International Economist for ING Group, said that fuel costs contributed significantly to the change but added, “there is evidence of broadening price pressures.”

“At the same time the ISM reports that customer inventories are at record lows and order books are full. The implication is that manufacturers potentially have the sort of pricing power we haven’t seen in years,” Knightly write in a note about the data release.

“Business surveys suggest pipeline price pressures continue to build with some surveys suggesting a greater ability to pass higher costs onto consumers.”

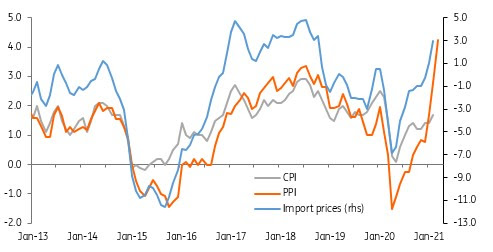

The PPI, formerly known as the Wholesale Price Index, measures price changes in goods and services used by industries, such as transportation, commodities, and energy costs. Data for the PPI is collected through a sampling of manufacturers, miners, and service industries.

The index, published monthly by the Bureau of Labor Statistics, can be a leading indicator of consumer price inflation. The Consumer Price Index, a separate inflation reading, is due out next week and is expected to rise sharply.

In a news release, the Bureau of Labor Statistics cited a number of recent drivers of the PPI, including a 13.5% jump in prices for iron and steel.