American Campus Communities (ACC), an Austin company that builds, owns, and manages student housing, booked $255.8 million in revenue in the fourth quarter of 2019, the company told investors in a quarterly report this week.

That’s a 4.1% increase from the same quarter in 2018 and puts the company on pace to earn a billion dollars in revenue yearly.

Based out of Hill Country Galleria in Bee Cave, American Campus Communities started in 1993 with just a single contract for student housing at UT Austin. It has since grown into a goliath in the student housing business nationally, worth more than $6 billion.

For the full year ended December 31, 2019, ACC booked total revenues of $943 million.

“The increase in revenue was primarily due to increased occupancy, rental rates and growth associated with recently completed development and presale development projects,” the company said in a summary earnings report.

ACC is a publicly traded company on the New York Stock Exchange, so it reports its financial results quarterly. The stock rose modestly in the two days of trading after it reported earnings.

Milestones

Austin is still one of ACC’s busiest markets, with students at the University of Texas snapping up dorms and pre-leasing rooms that haven’t even been built yet.

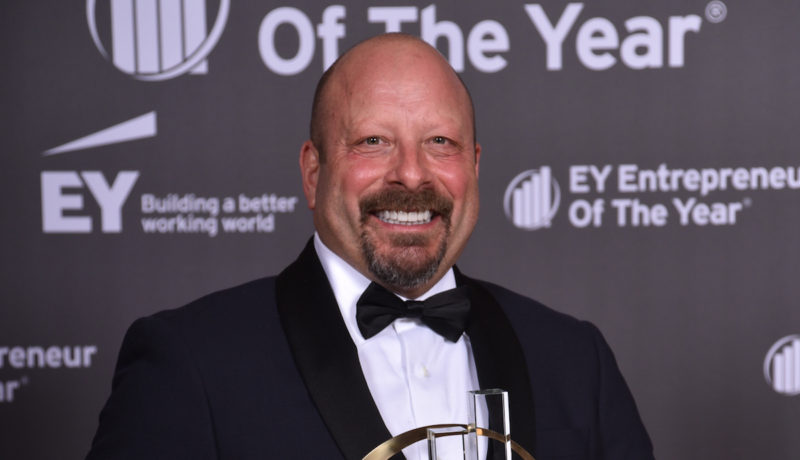

“Austin continues to be in the top 10 supply markets. Currently, our leasing progress is going well,” said CEO Bayless in a conference call with investment analysts on Feb. 19. “The two new developments that (we have) are virtually already pre-leased, which has been the trend in UT Austin; everything new immediately leases up.”

“We are successfully capturing market share. So we certainly believe we are in a position to build off of where we were last year,” he added.

Elsewhere, ACC completed the sale of a 606-bed property in Ann Arbor, Michigan with proceeds of $100 million. It is nearing the sale of a property near the University of Maryland, which will bring in $148 million. The return on these investments is about 4%, ACC reported.

ACC says another recent milestone is being selected as the strategic housing master plan partner for West Virginia University. The award includes various renovations and redevelopments of on-campus housing.

Cheap Debt

Real estate trusts like ACC typically have a fairly complicated capital structure that involves different tranches of debt maturing at different dates. ACC’s balance sheet at year end showed total liabilities for the company of about $4.1 billion.

The company is taking advantage of low interests rates to make servicing its debt cheaper, recycling out older higher-cost debt for new low-cost debt.

On January 30, ACC tapped capital markets for $400 million in new funding maturing in 10 years at a coupon rate of 2.85%. ACC commented that this was “a record low credit spread” for a real estate company of its kind.

The company used the money to prepay $400 million of 3.35% unsecured notes. The prepayment helped reduce the overall average interest rate on the company’s debt portfolio.

2020 Outlook

Looking ahead, ACC expects higher labor costs and insurance costs to weight on profits, even as revenue continues to grow.

Chief Operating Officer Jennifer Beese said, “We expect a double-digit expense growth in insurance based on current market conditions. And payroll expenses are expected to increase in the area of 5%, being influenced by changes to (labor law), as well as statutory minimum wage increases in numerous states.”

That means that expense growth could outpace revenue growth. ACC forecasts expenses to grow about 2-3%, while revenue will grow 1-2%, Beese said.