If Austin voters skip one of the last questions on the ballot in the 2020 election, Proposition A, then they’ll miss out on deciding an important local issue.

The ballot language of Proposition A is wordy and dense, but basically it asks a simple question: should the taxpayers fund new light rail and buses?

The proposal would put into action a plan known as Project Connect, which calls for three new passenger rail lines, an underground tunnel downtown, and a variety of new bus routes, all managed by the region’s local transit authority, Capital Metro (CapMetro).

So someone who thinks that, yes, the city needs new commuter rail and an improved bus system might be inclined to vote ‘yes’ on Prop A; otherwise, they might vote ‘no.’

But the ballot question isn’t just about mass transit in the abstract. It’s actually the funding mechanism for Project Connect. It’s what’s called a “tax rate election,” or rollback election, which is triggered when a city council votes to increase the tax rate more than a certain limit in a given year.

The proposition calls for approving a higher “ad valorem (property) tax rate… for the purpose of providing funds for a citywide traffic-easing rapid transit system known as Project Connect…”

Project Connect’s “initial investment” phase is estimated to cost $7.1 billion, about half of which would be paid for by local tax dollars. Planners hope to secure a 45% matching share from the federal government.

However, if the tax is approved, it would be a permanent increase that would endure beyond the initial phase of $7.1 billion. Proposition A is not a one-time bond election.

What is the Tax Impact of Proposition A?

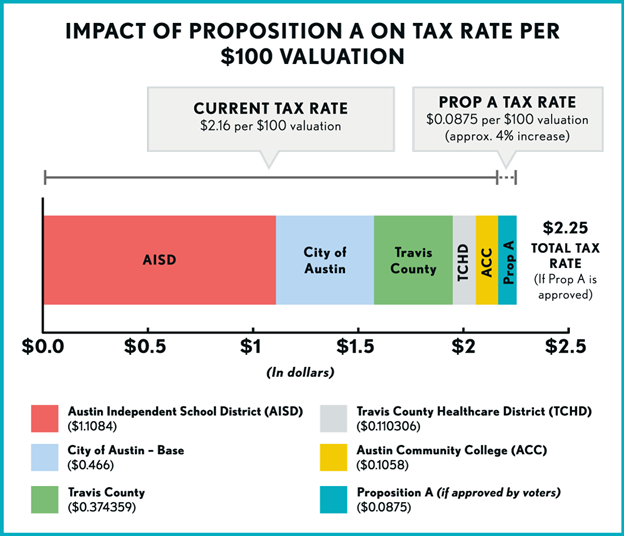

Supporters and opponents of Proposition A differ in how they describe the tax impact, so voters may see different numbers thrown around as to how big the increase actually is. Supporters tend to call it a tax hike of “8.75 cents” per $100 valuation, and critics generally describe it in percentage terms.

The ballot language itself asks voters to approve a property tax rate of $0.5535 per $100 of property valuation before exemptions. That rate is 8.75 cents higher per $100 valuation than the voter-approval tax rate, a 20.4% increase over the current level.

What this means is that Proposition A is really a tax increase on top of a tax increase, because the increase of 8.75 cents comes on top of the “voter-approval rate,” which is already higher than the current property tax rate. The “voter-approval rate” is the maximum the City Council is allowed to increase the property tax rate without a tax election.

In order to keep revenues flat, the City Council actually could have reduced the tax rate to the “no-new-revenue rate” of $0.4284 per $100 valuation from the current rate of $0.4431 per $100 valuation. That’s because of new property on the tax roll and increases in property values.

Instead, the council voted in August to increase the tax rate to the voter-approval rate, which boosts revenue by 3.5% for city operations, while separately asking voters to approve a further increase (Proposition A) for mass transit.

The price tag for the average homeowner?

In a legally required notice, the city estimated the “tax on average homestead” will increase by $423.53 yearly under the new rate to a total of $2,143. That figure is based on an average homestead taxable value of $401,644.

And that’s just the city’s share of property tax. Together with the Austin ISD tax, Travis County tax, Austin Community College tax, and Central Health tax, the average homeowner will see a yearly property tax bill of $8,943.

The Prop A portion of that overall bill would be about 4%.

New Routes

Austin currently only has one commuter rail, the Red Line, which runs from Leander to the Downtown. If Proposition A is approved, it would add a Blue Line running from the Downtown station next to the Convention Center to the Airport, with stops along the way.

A new Orange Line would run north-south along North Lamar and South Congress, from 183-N in the north to Stassney Lane in the south. Eventually the route could be extended north to Parmer Lane and Tech Ridge, and south to Slaughter Lane.

The Blue and Green lines would connect through a downtown tunnel running from Republic Square to the main station next to the Convention Center. Planners argued that the downtown tunnel was necessary, despite its high cost, because otherwise the trains would impede traffic flow downtown and create gridlock.

Finally, the new Green Line would run east and northeast from the Downtown to Pleasant Valley and Colony Park. Eventually it could be extended to Manor and Elgin along an existing rail line.

Project Connect also would add four new “rapid bus” routes with limited stops along the way:

- The Gold Line (from ACC Highland to South Congress and Ben White Blvd)

- Expo Center (from East Austin to UT Austin and downtown)

- Pleasant Valley (from Mueller to the Goodnight Ranch Park & Ride)

- Burnet (from The Domain to Menchaca and Oak Hill)

Arguments For and Against

For supporters of Proposition A, new mass transit is essential for relieving traffic congestion. Austin is one of the largest U.S. cities without a commuter rail system, other than the Red Line.

More rail routes and bus connections would make it easier for Austinites to take public transit, boosting ridership. They also argue that a better mass transit system would get cars off the road, shorten commute times for the remaining drivers, improve the environment, and make the city more affordable to low-income people who struggle to maintain a personal automobile.

Critics, on the other hand, generally focus on the tax impact of the plan, the timing of the tax hike in the midst of a recession, and the possibility of cost overruns.

Some critics also argue that by the time Project Connect is completed it could be overtaken by new transit technologies, such as self-driving cars that improve traffic flow.

Opponents include the political action committee Our Mobility Our Future, which is backed by some politically conservative donors, including Travis County Commissioner Gerald Daugherty, a long-time foe of mass transit, who gave $14,000 to the committee.

But some Progressives are also apposed to the plan, arguing that the tax impact would disproportionately affect low-income and middle-income homeowners and accelerate the process of gentrification affecting Black and Hispanic communities.

In general, however, elected Democrats have supported Project Connect, including the mayor and 10 city council members who voted unanimously to put Proposition A on the ballot.

Ballot Language

On the ballot, voters will see Proposition A under the heading “City of Austin Tax Rate Election.” It will say:

“Approving the ad valorem tax rate of $0.5335 per $ 100 valuation in the City of Austin for the current year, a rate that is $0.0875 higher per $100 valuation than the voter-approval tax rate of the City of Austin, for the purpose of providing funds for a citywide traffic-easing rapid transit system known as Project Connect, to address traffic congestion, expand service for essential workers, reduce climate change emissions, decrease traffic fatalities, create jobs, and provide access to schools, health care, jobs and the airport; to include neighborhood supportive affordable housing investments along transit corridors and a fixed rail and bus rapid transit system, including associated road, sidewalk, bike, and street lighting improvements, park and ride hubs, on-demand neighborhood circulator shuttles, and improved access for seniors and persons with disabilities; to be operated by the Capital Metropolitan Transportation Authority, expending its funds to build, operate and maintain the fixed rail and bus rapid transit system; the additional revenue raised by the tax rate is to be dedicated by the City to an independent board to oversee and finance the acquisition, construction, equipping, and operations and maintenance of the rapid transit system by providing funds for loans and grants to develop or expand transportation within the City, and to finance the transit-supportive anti-displacement strategies related to Project Connect. Last year, the ad valorem tax rate in the City of Austin was $0.4431 per $100 valuation.”