ANALYSIS

The U.S. dollar has fallen 6.4% against a basket of other currencies from a year ago, a move that might have been even larger had it not been for the rapid U.S. vaccine rollout that outpaced most other nations.

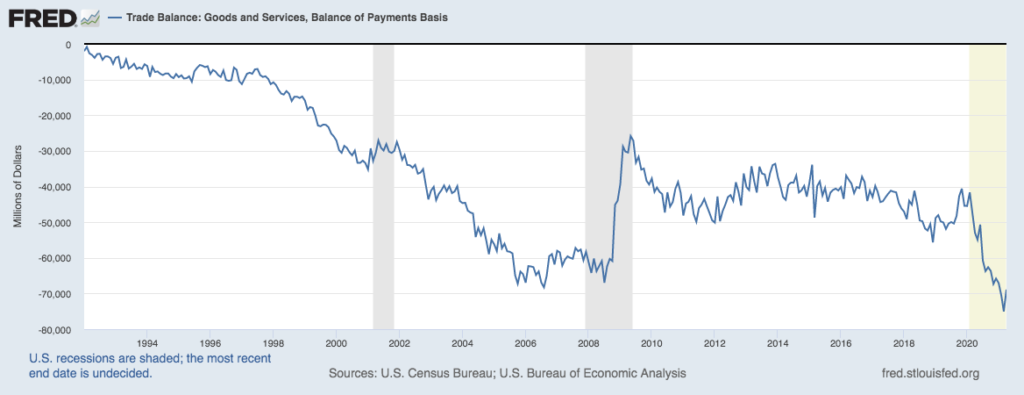

The greenback’s slide has coincided with a sharp increase in the U.S. trade deficit, which reached a record high this spring as Americans gobbled up goods from China, Mexico, Vietnam, and other exporting nations.

The pandemic acted as an accelerant on the long-widening trade gap, prompting Americans to shift their spending from services to stay-at-home goods like furniture, electronics, and kitchenware, most of which are produced overseas.

As an import-dependent nation, the U.S. could be harmed if its currency continues to weaken against other currencies. It will become costlier for Americans to buy foreign goods, pressuring households and small businesses.

But a weaker dollar also makes it easier for foreigners to buy U.S. goods, potentially boosting sales for exporters, including Texas farmers, energy producers, and manufacturers. It also means that firms that generate revenue overseas in foreign currencies can repatriate it at a more favorable rate of exchange.

Texas is by the largest exporter among the U.S. states, holding a $123 billion lead over California in 2020. As such, Texas would benefit disproportionately from a continuing decline in the U.S. dollar, even if not all Texans would benefit equally from this trend.

Already there are some indications that the weaker dollar might be helping. Texas goods exports surged to $29.7 billion in April, surpassing the pre-pandemic levels for the first time, following a brief 0.5% pullback in March amid storm-related supply hiccups.

In a recent publication, the Federal Reserve Bank of Dallas noted that Texas exports to China “skyrocketed” in March, and exports to the rest of Asia and to Canada also saw “strong growth.”

That trend coincides with a sharp appreciation of the Chinese yuan, which rose 8.2% against the dollar in the second half of 2020 and another 2% year-to-date. Likewise, the Canadian dollar has strengthened against the U.S. dollar to a recent six-year high, in part because the Canadian central bank has been more hawkish than the Federal Reserve.

Similarly, the Mexican peso has strengthened against the dollar since last spring, though it remains weaker than it was before the pandemic and has been held back by political uncertainty and a slow economic recovery. The strength of the peso is significant for Texas because Mexico is the state’s largest trade partner. Mexican imports from Texas include oil, gas, chemicals, computers, machinery, fabricated metals, aircraft, and agricultural products.

These types of currency fluctuations aren’t noticeable day-to-day, but they’re important for the long-term economic outlook. A weaker greenback augurs well for many large Texas companies. It might also help ranchers and farmers who produce export crops like soybeans and cotton.

But it will be hard for most ordinary Texans to ride this wave to their benefit. The state’s growing population coupled with a lack of unionization will make it difficult for workers to negotiate higher wages to offset the higher costs of imported goods.

On the whole, a weaker dollar is a mixed blessing for the Texas economy.

Disclaimer: Economic analysis and commentary reflect the views of the author. Not financial advice. © Honest Austin.