ANALYSIS

Americans are spending more money than ever before online, a trend that may generate considerable price pressure in the resurgent post-pandemic economy.

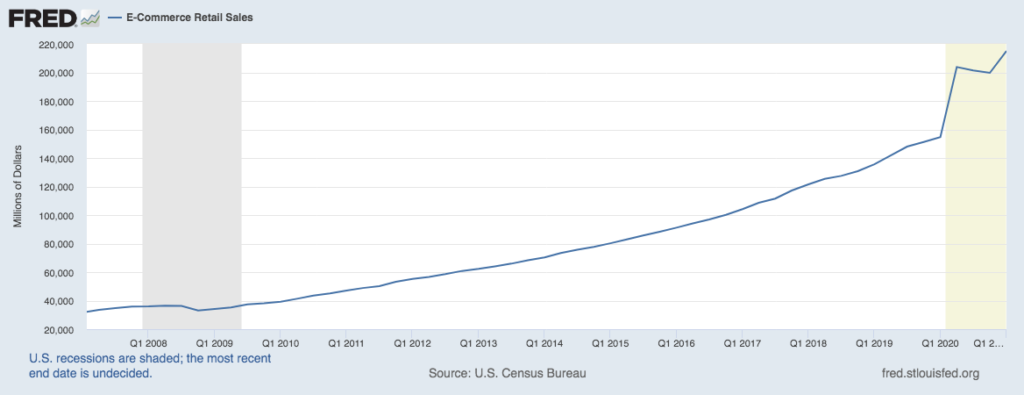

Online retail sales spiked an astonishing 32% from the first to second quarter of 2020, from $154.6 billion to $203.8, in spite of mass layoffs in the service sector of the economy.

That number rose further to $215 billion in Q1 this year — and that was before a big stimulus-fueled spending bump in April and May.

E-commerce now accounts for about 14% of total retail sales, roughly triple what it was a decade ago, and the pandemic year accounts for a quarter of that gain.

Online shopping is habit-forming, so the longer this goes on, the less likely it is that the trend will revert in any meaningful way.

Moreover, the pandemic has given e-commerce titans like Amazon more than a year to consolidate their edge over traditional retailers in practically every respect, from brand recognition to consumer data, warehousing to logistics.

Granted, the current ‘reopening’ environment favors in-store retailers. Formerly homebound shoppers, perhaps seniors especially, are making up for lost time. That could mean e-commerce sales take a bit of a breather in coming months.

But if stock market signals are any guide, the upward climb should continue; the share price of Amazon has nearly doubled since the outset of the pandemic in March 2020, and is up 369% over the past five years.

Likewise, shares of Canadian e-commerce company Shopify are up 325% since March 2020, and China’s Alibaba rose 25%, highlighting that the e-commerce phenomenon is expected to be a global one.

Those share prices reflect an ample dose of speculation, but they’re also grounded in the expectation, likely accurate, that online sales will continue to grow.

So What?

- Wage pressure: The online retail economy requires fewer low-paid store clerks and stockers but more more higher-paid truckers and delivery workers. The transition will therefore add to overall wage pressures in the U.S. economy.

- Growing pains: E-commerce may appear more efficient from the shopper’s perspective, but it actually requires more fuel, trucks, cardboard, plastic, warehouse space, and robotics. Therefore a continuing expansion of e-commerce could further stretch supply chains at a time when bottlenecks are already causing goods prices to spike. This dynamic should challenge the prevailing narrative that current supply bottlenecks are merely transitory. The shift toward e-commerce is a secular trend — one that will unfold over a long time horizon — not a short-term one.

- Market consolidation: Market share in online retail is concentrated with a just a handful of mega-retailers, with Amazon estimated to control about 49% of online spending in the U.S. That gives Amazon substantial pricing power, which it could use either to undercut rivals or to hike prices without fear of losing market share. Historically, the Amazon effect has been deflationary — causing firms to limit price increases so as not to be undercut by their larger rival. But eventually that effect could reverse as Amazon begins to flex its market muscle, fueling goods inflation in coming years.

Disclaimer: Economic analysis and commentary reflect the views of the author. Not financial advice. © Honest Austin.